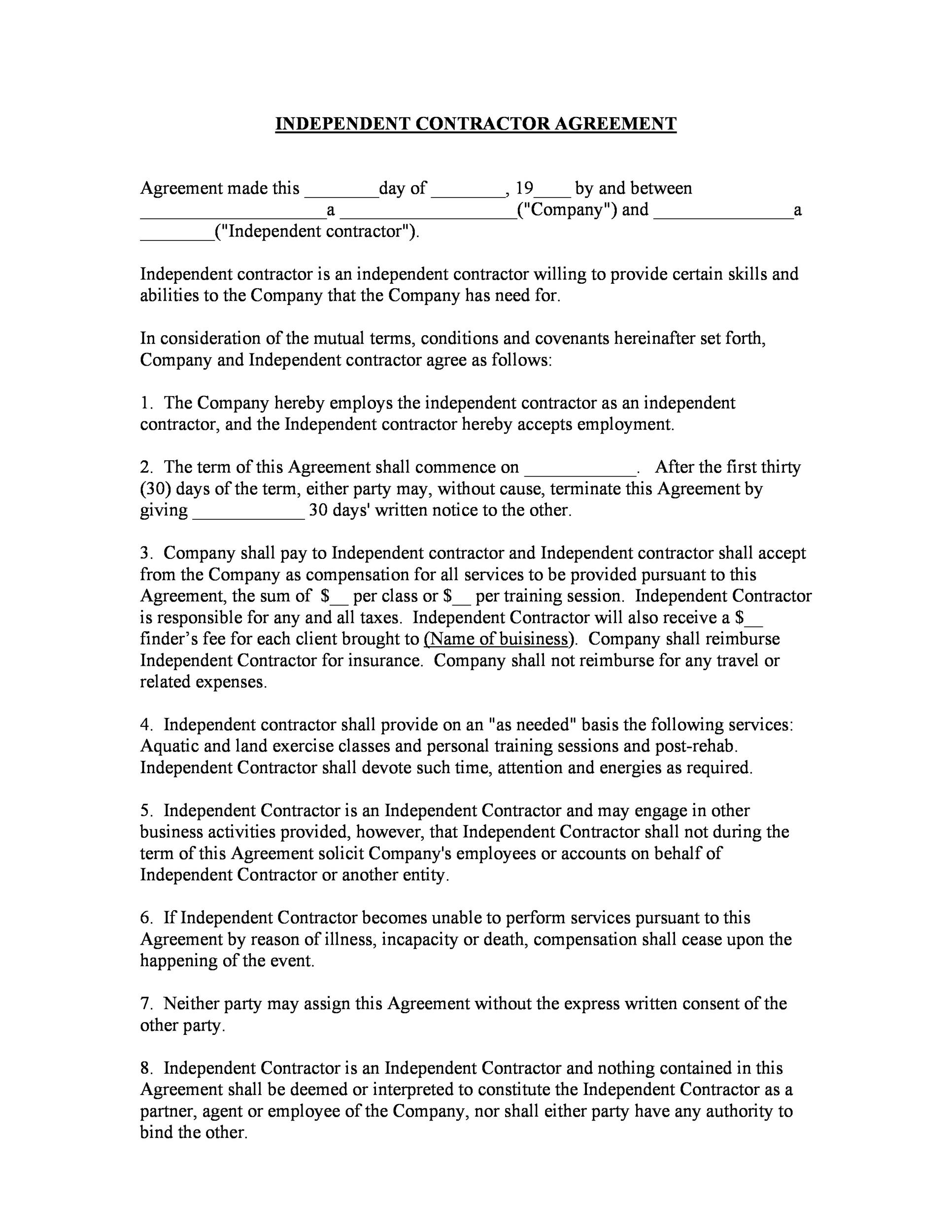

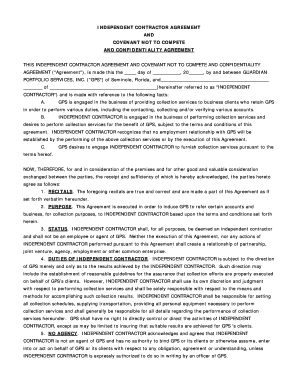

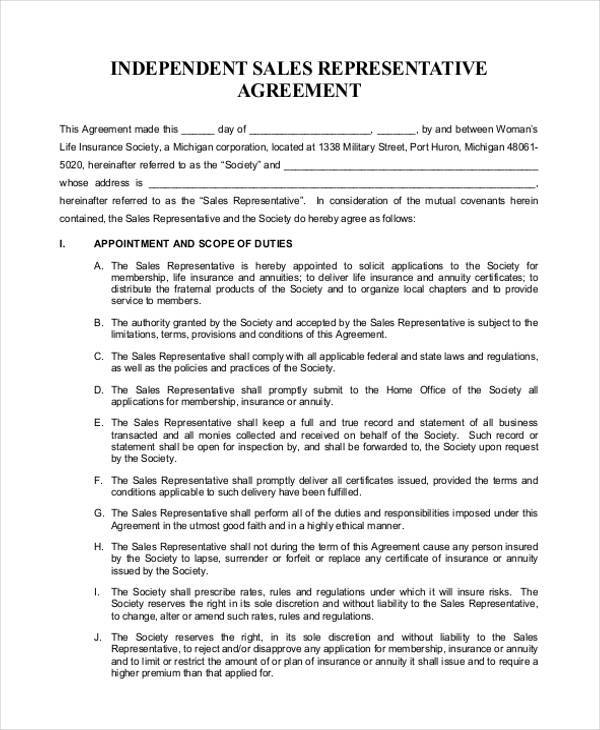

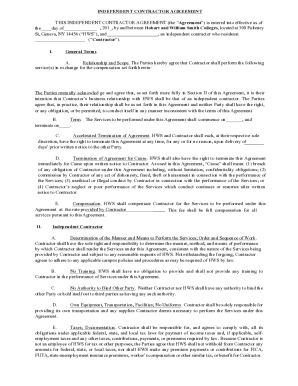

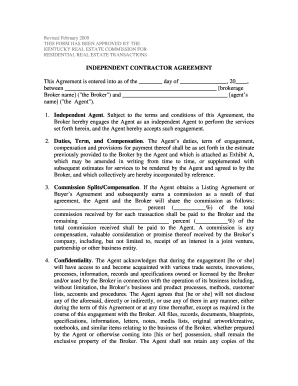

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the other4 Contractor affirms that Contractor is not subject to any agreement or covenant not to compete which would prohibit or limit Contractor from fulfilling this Agreement;Service (IRS), is an independent contractor, and neither the Contractor's employees or contract personnel are, or shall be deemed, the Client's employees In its capacity as an independent contractor, Contractor agrees and represents Contractor has the right to perform services for others during the term of this Agreement;

1

What should be included in an independent contractor agreement

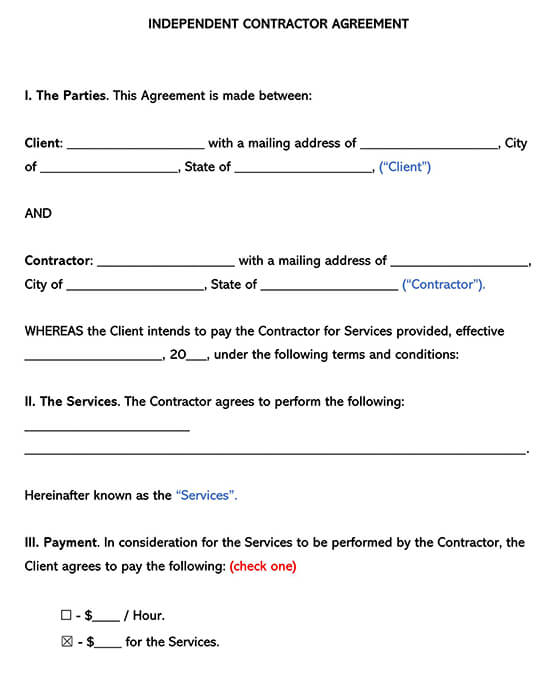

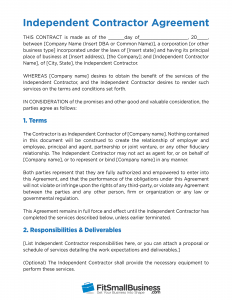

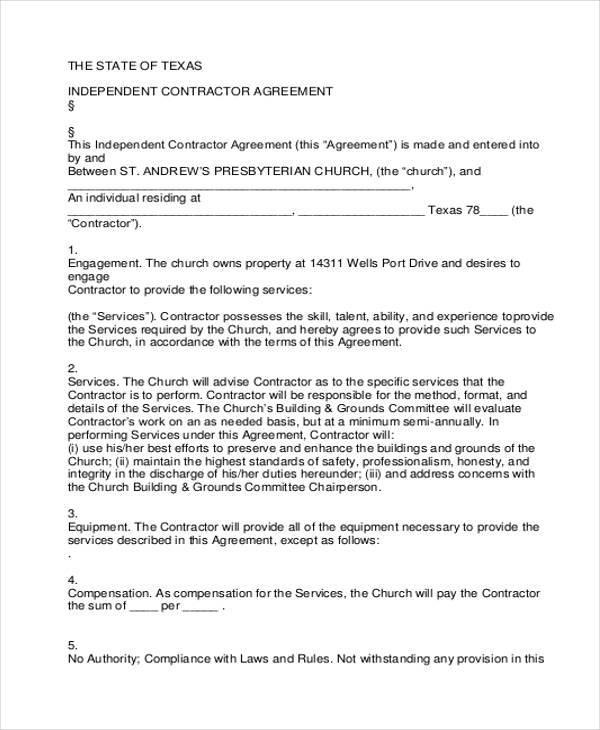

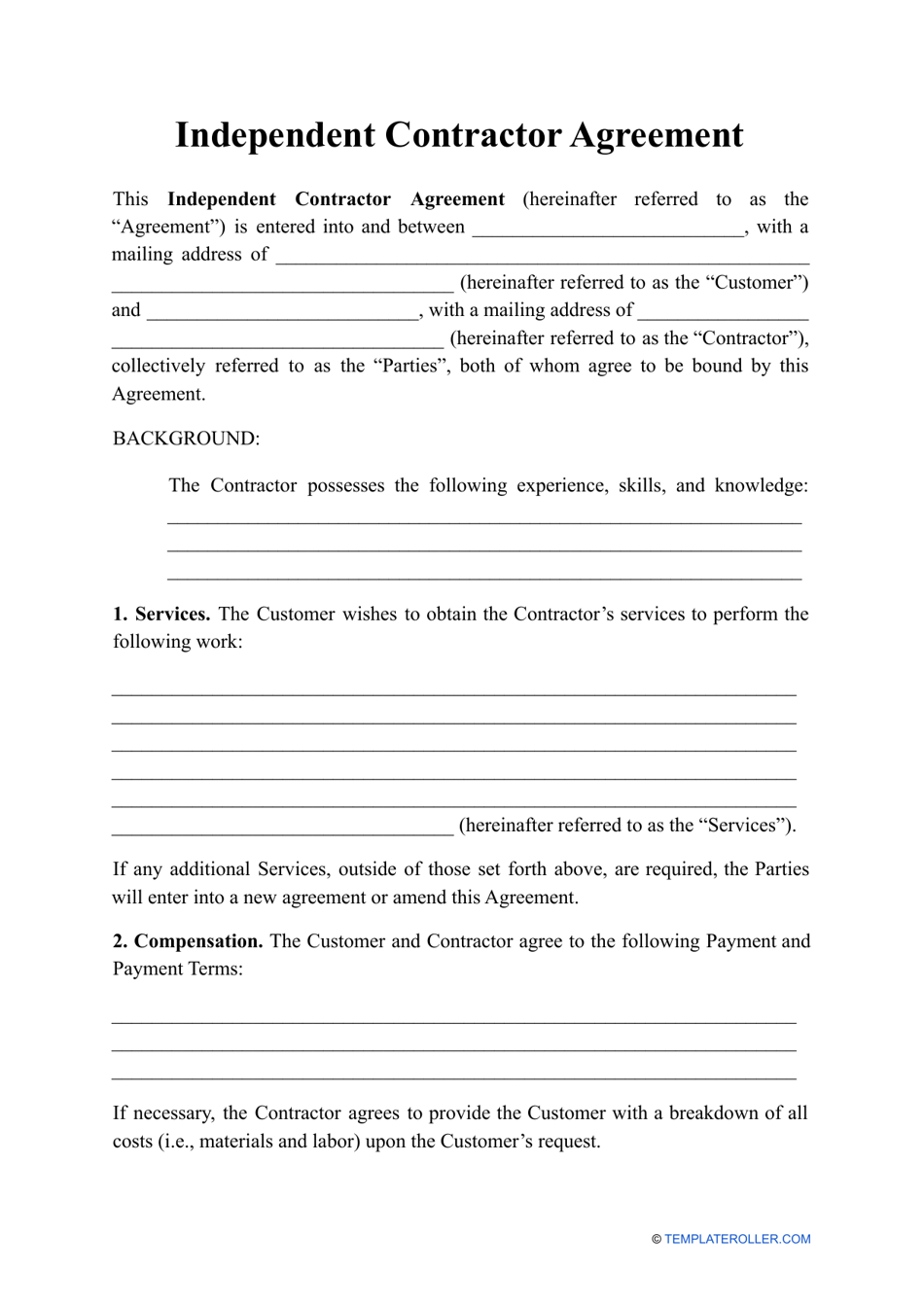

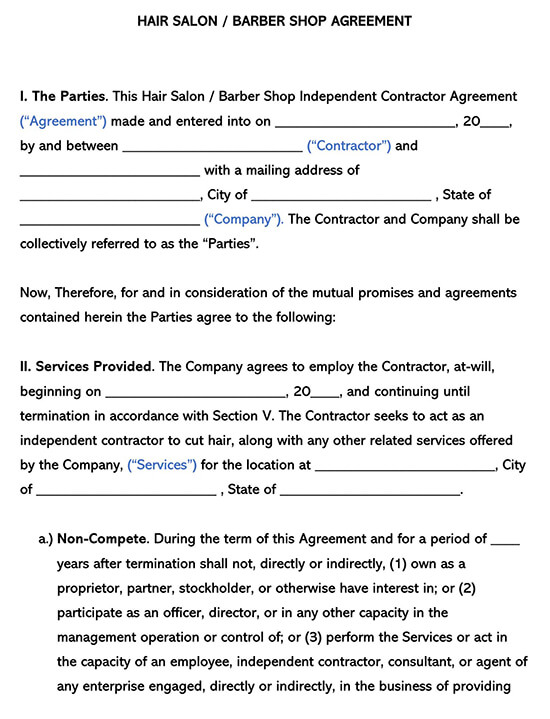

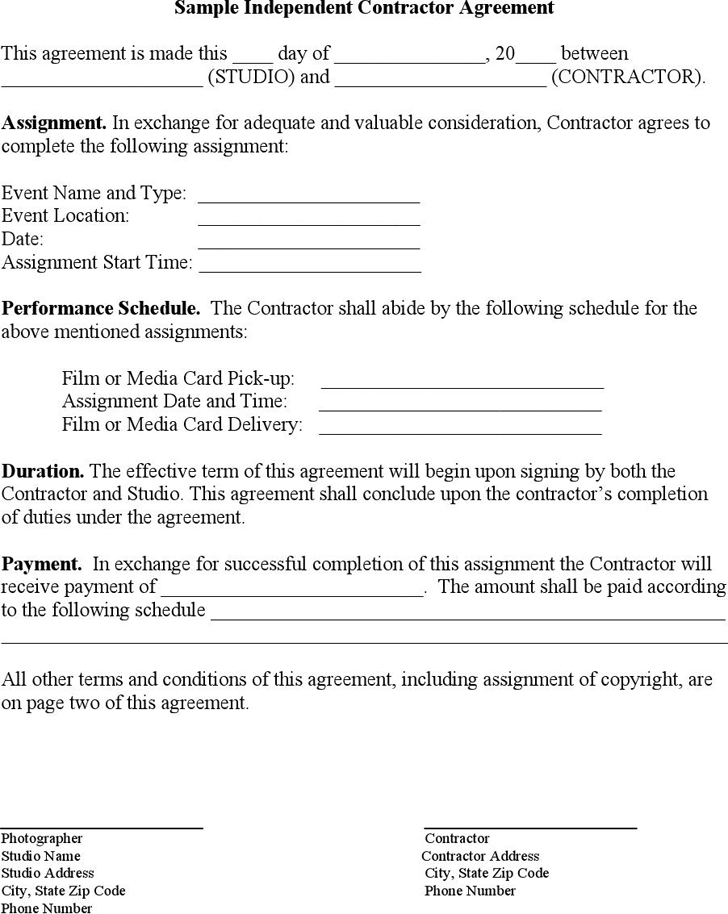

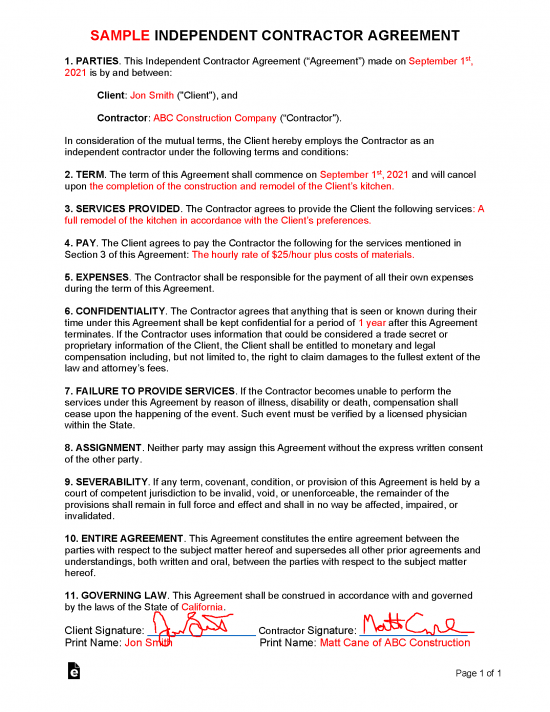

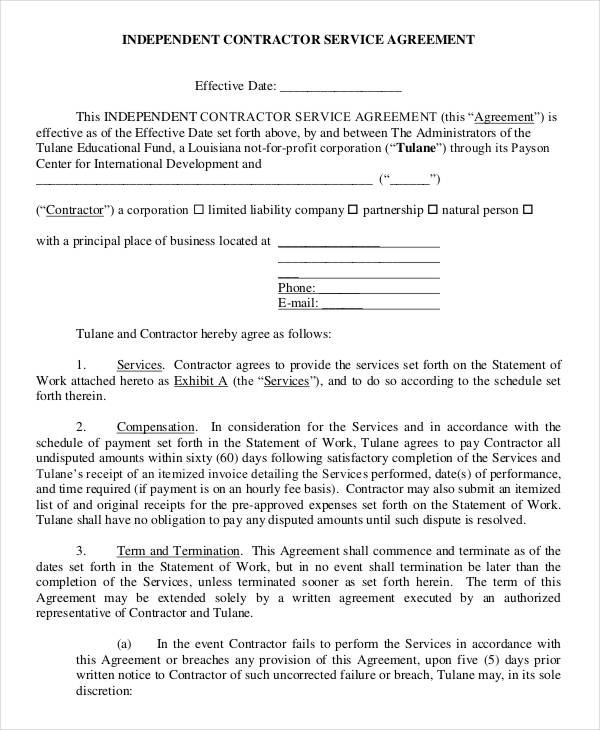

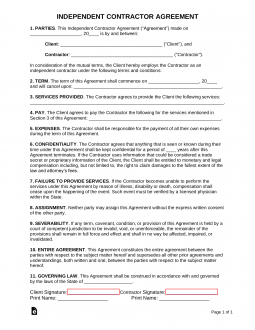

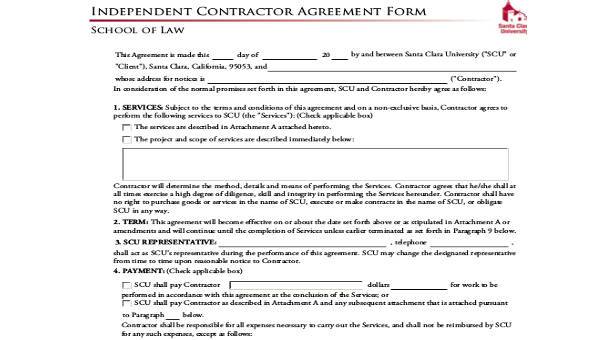

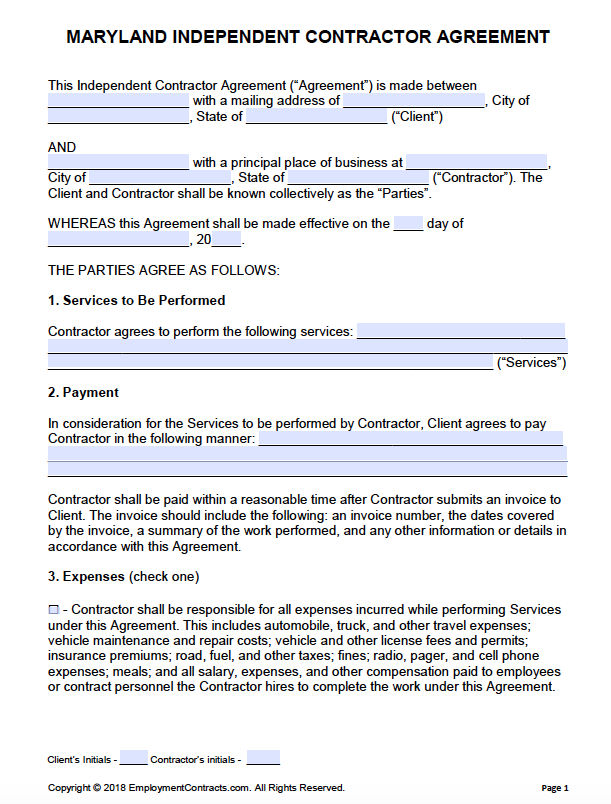

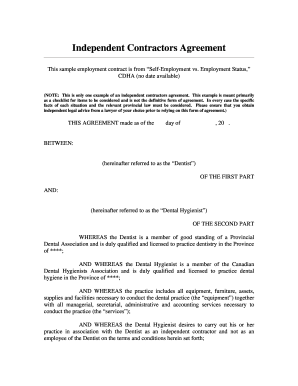

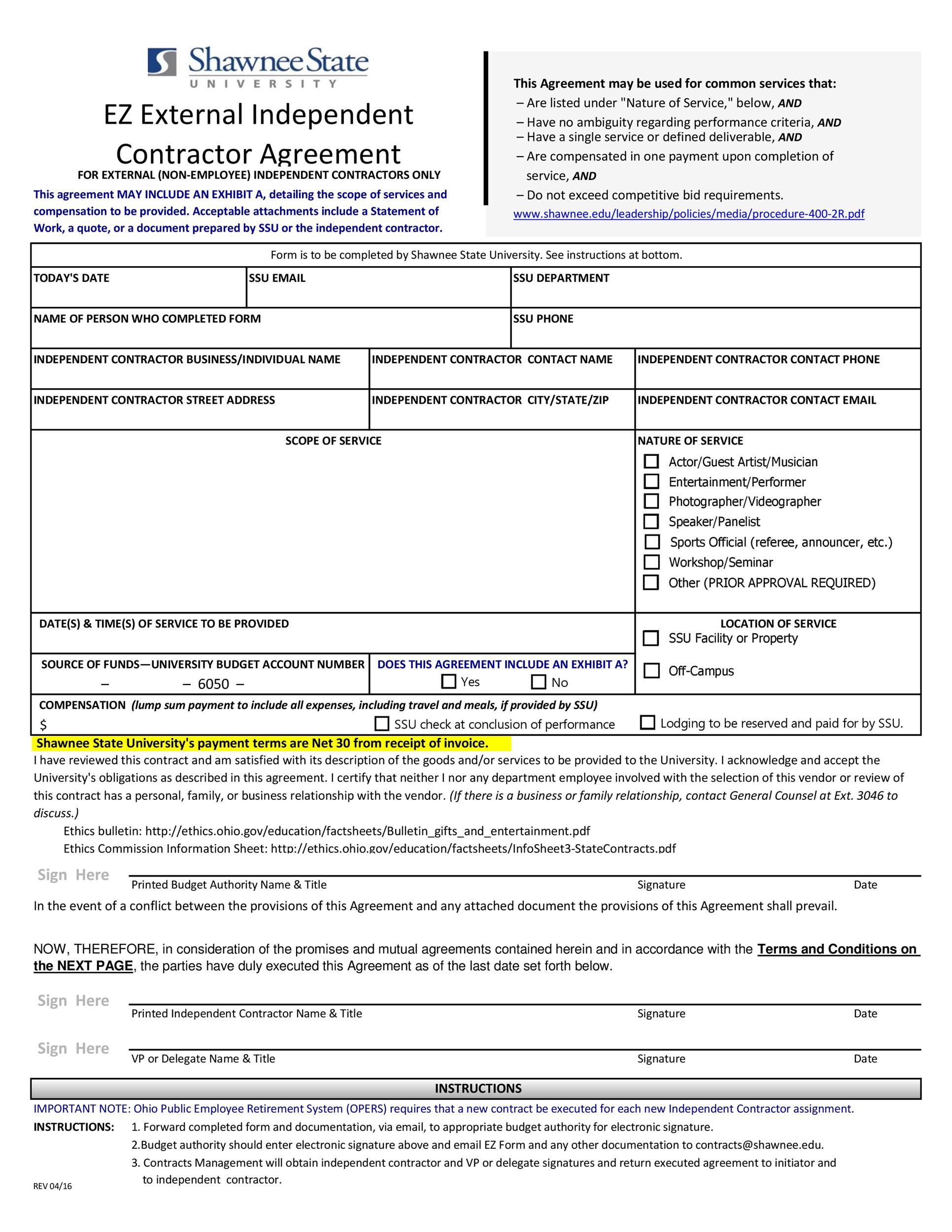

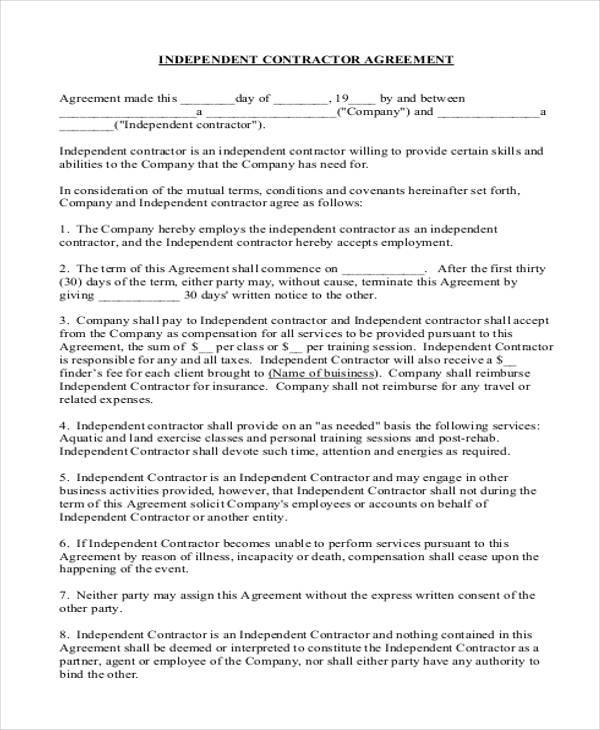

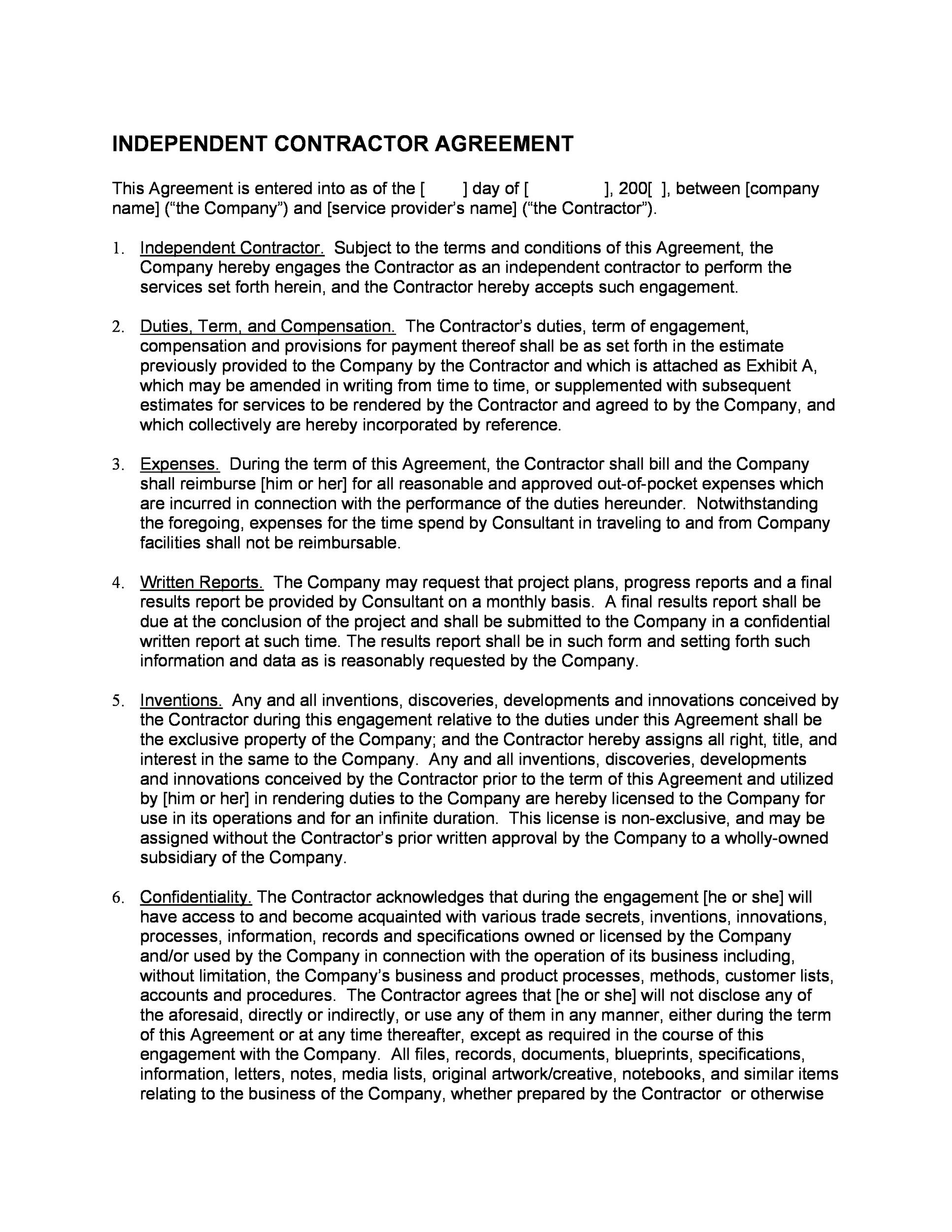

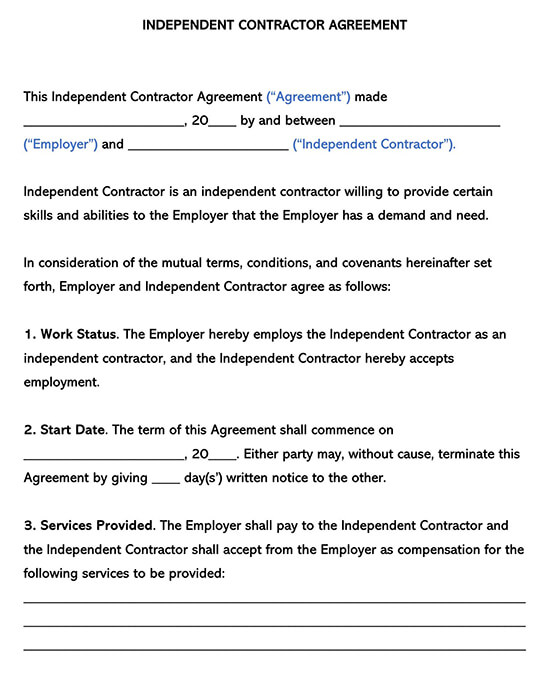

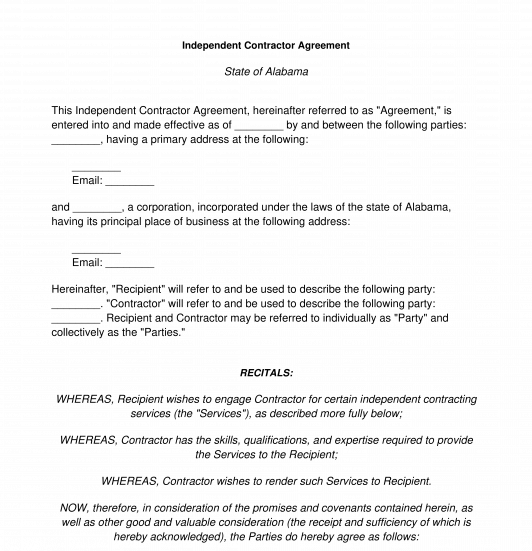

What should be included in an independent contractor agreement- free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreementINDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT is between Family Counselling and Support Services for Guelph Wellington (the "Company") and XXXX (the "Contractor") (collectively referred to as the "Parties") This contact will be in effect from – 1x to 1x In consideration of their mutual promises, the Parties agree as follows

Independent Contractor Template Contract For Va S The Legal Paige

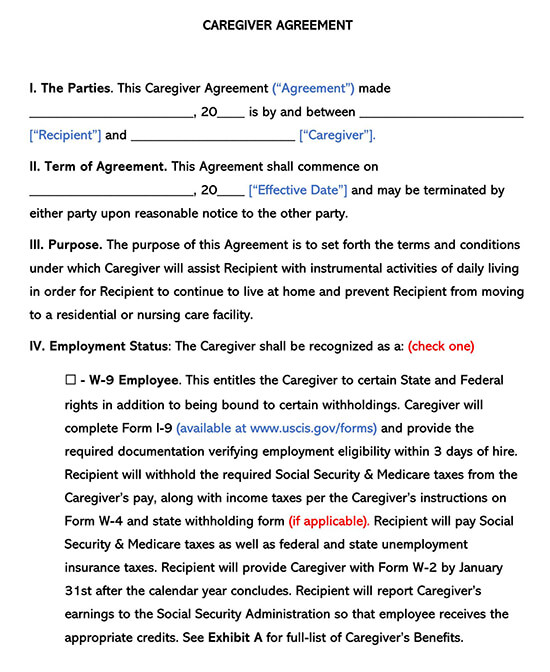

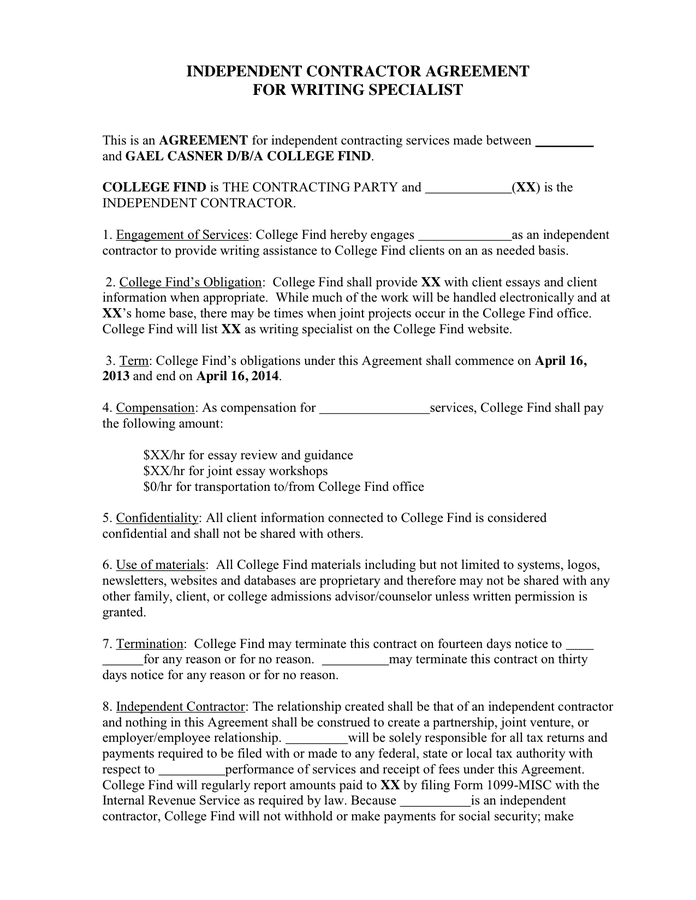

Download Nursing Agreement SelfEmployed Independent Contractor right from the US Legal Forms site It gives you a wide variety of professionally drafted and lawyerapproved documents and samples For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way Contractor An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injured

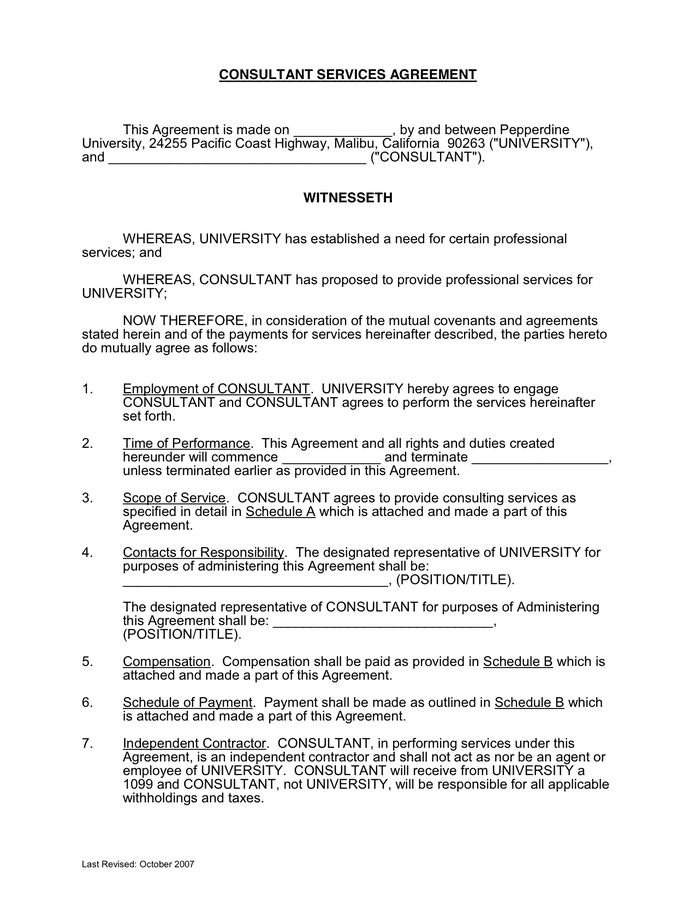

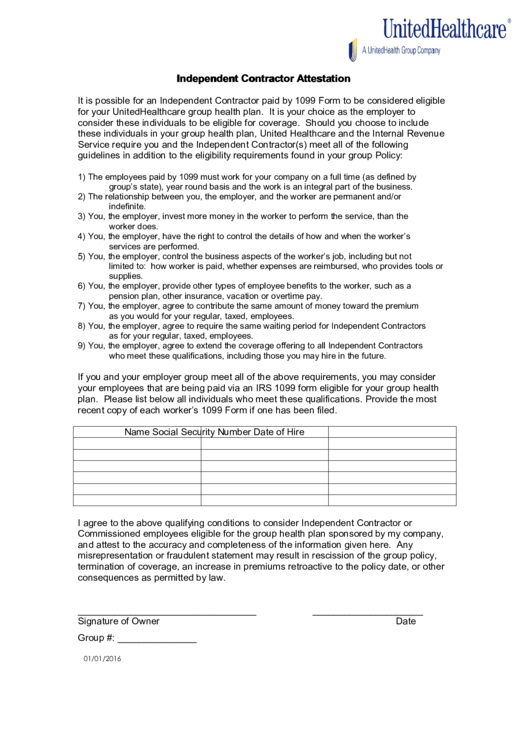

As well as your own health benefits, medical expenses, life insurance, and retirement fundThe Georgia independent contractor agreement is a device that a company or individual may use during the hiring process to indicate their operating terms to an independent contractorBy executing an agreement at the start of a working relationship, the hiring party confirms the worker's knowledge of their responsibilities, wage, and the date the requested duties must beBecause Consultant is not an employee of the Company, but rather an independent contractor, the Company shall issue an IRS Form 1099 Consultant agrees to report all compensation received under this Agreement to the appropriate federal, state or local taxing authorities

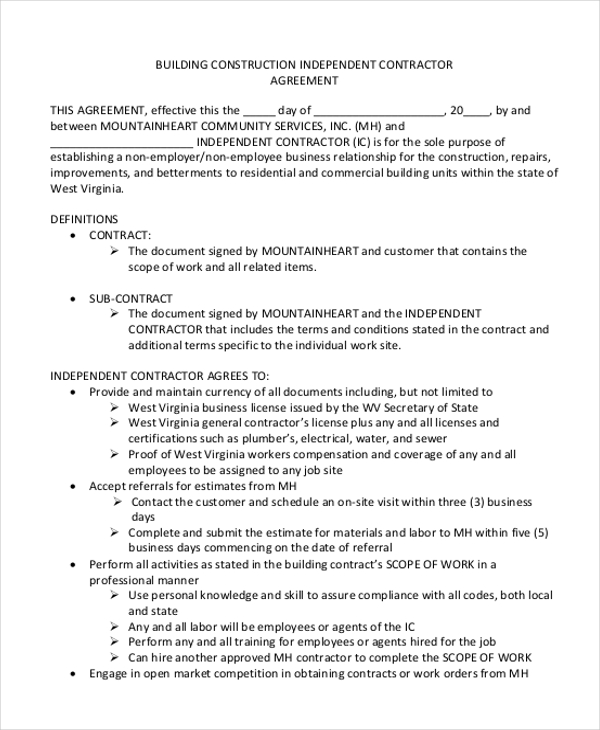

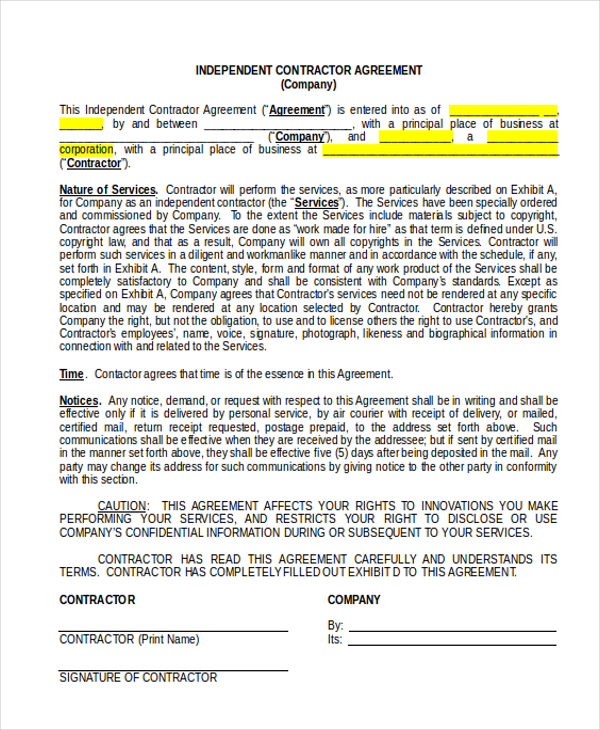

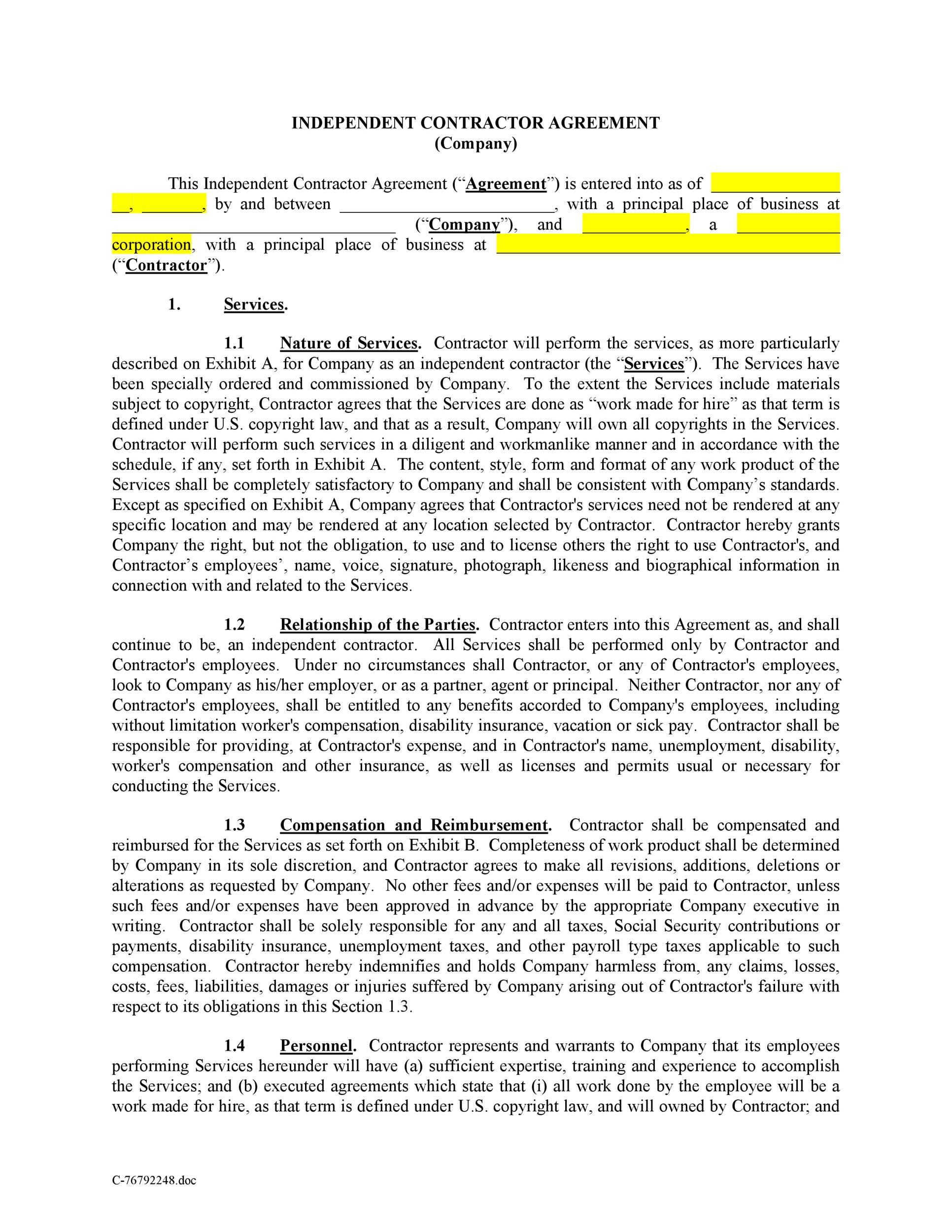

Independent Contractor Status The parties acknowledge that Contractor is and shall at all times be an independent contractor and not an employee of the Companies The parties agree a The Companies shall have no right to direct the manner in which Contractor performs the Services;Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)Independent Contractor Agreement DeMarseCo Holdings Inc and Daniel H Smith () Independent Contractor Agreement RedEnvelope Inc and John Roberts () Independent Contractor Agreement Western Brands LLC and Ronald Snyder () Independent Contractor Agreement CytRx Corp and Louis J Ignarro ()

Independent Contractor Driver Agreement Pdf Independent Contractor Cargo

Independent Contractor Agreement Not Your Father S Lawyer

Sample Clauses Independent Contractor Indemnification Consultant agrees to indemnify and hold harmless YETI and its members, managers, directors, officers, employees and affiliates from and against all taxes, losses, damages, liabilities, costs and expenses, including attorneys ' fees and other legal expenses, arising directly or indirectly from or in connection with (i) any negligent, reckless or intentionally wrongful act of Consultant or Consultant'sProvided however, the Services must be provided at the1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax returnThe employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work

3

Lsoa School 1099 Agreement

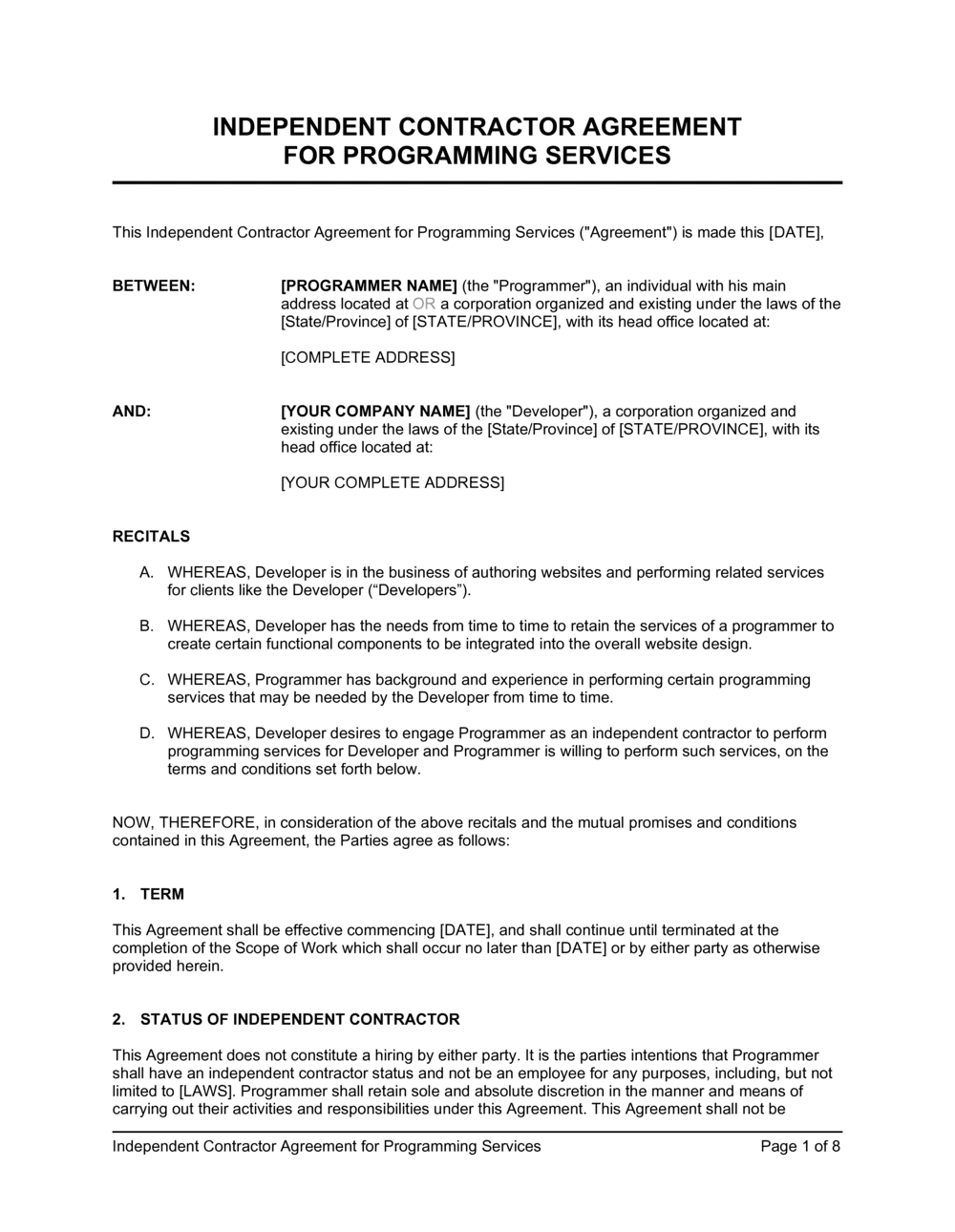

Exhibit 102 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT ("Agreement") is made and entered into as of , by and between ProDex, Inc (the "Company"), with its principal place of business located at 2361 McGaw Ave, Irvine, California , and Mark Murphy ("Independent Contractor"), an individual with his principal this is an agreement for independent contracting services the contracting party provides no benefits such as unemployment insurance, health insurance or worker's compensation insurance to independent contractor contracting party is only interested in the results obtained by the independent contractor independent contractor shall be responsible for providing allIndependent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement For Programming Services Template By Business In A Box

(ii) that their classification as an independent this is an agreement for independent contracting services the contracting party provides no benefits such as unemployment insurance, health insurance or worker's compensation insurance to independent contractor contracting party is only interested in the results obtained by the independent contractor independent contractor shall be responsible for providing allThe agreement needs to make it clear that the independent contractor will be a 1099 employee, meaning that the contractor will receive a 1099 form and be responsible for payment of taxes on his or her own The contractor will need to figure these

Independent Contractor Consultant Agreement In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year; An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreementsAs well as your own health benefits, medical expenses, life insurance, and retirement fund

Free Independent Contractor Agreement Template What To Avoid

Create An Independent Contractor Agreement Download Print Pdf Word

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees The Service Agreement, which referred to Ryes as a contract driver, established that Ryes was not an employee of Scout, but the agreement was consistent with Ryes being an independent contractor Id at 415 Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis

Self Employed Vs Independent Contractor What S The Difference

How To Write An Independent Contractor Agreement Mbo Partners

Agreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;Contractor is an independent individual or entity It is engaged in the business of providing services to third parties of the nature described in the Scope of Work contemplated by Section 11 of this Agreement Client wishes to retain Contractor for such services on the basis set out in this Agreement 1 Services and Fees 11 Services_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for your own taxes through a 1099 tax form at the end of every filing year;

Independent Contractor Agreement Template Free Pdf Sample Formswift

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Contractor enters into this Agreement as, and shall continue to be, an independent contractor All Services shall be performed only by Contractor and Contractor's employees Under no circumstances shall Contractor, or any of Contractor's employees, look to Company as his/her employer, or as a partner, agent or principalDownload this customizable sample independent contractor agreement by Ryan Robins An easy to fill general independent contractor contract sample by Jyssica Schwartz This flexible work for hire agreement sample from Docsketch While we've done our best to find useful contract templates for you, this isn't legal advice, and Wise cannot be heldAn independent contractor agreement is a contract between an independent contractor and the business or individual needing their services It explains the duties of both parties involved The agreement also includes a detailed description of the job that should be done, how it should be done, the payment and when it will be made, and other clauses such as a confidentiality clause

1

Independent Contractor Agreement Not Your Father S Lawyer

INDEPENDENT CONTRACTOR AGREEMENT EXHIBIT 102 This Independent Contractor Agreement (this "Agreement") is entered into as of DATE, between Aquarius Holdings LLC, a Colorado Limited Liability Company with its principal place of business located at 2549 Cowley Dr, Lafayette, CO , and any and all of its successors, assigns, affiliates, and subsidiaries, (theINDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either partyA business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and how

1099 Form Independent Contractor Agreement

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall include, but are not limited to the following The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Order and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600The Independent Contractor that Contractor considers materially harmful to the Practice No notice is required if this agreement is terminated for cause Independent Contractor agrees to immediately notify Contractor in the event Independent Contractor's license to practice psychology, therapy, orAgreement upon _____ days written notice to Employer This Agreement also may be terminated at any time upon the mutual written agreement of the Employer and Property Manager SECTION 5 INDEPENDENT CONTRACTOR STATUS 51 Property Manager acknowledges that he/she is an independent contractor and is not an agent,

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Independent Contractor Agreement Template Contract The Legal Paige

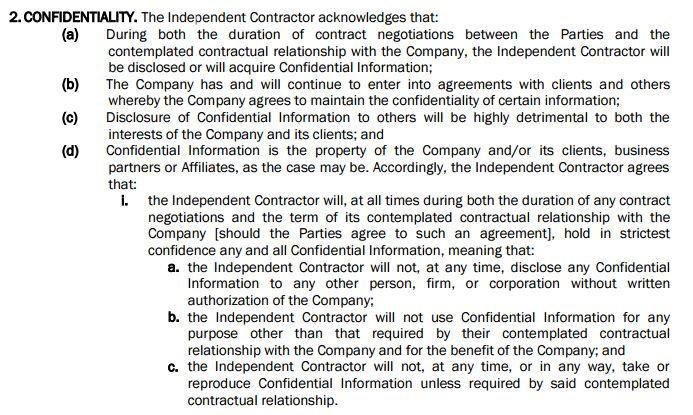

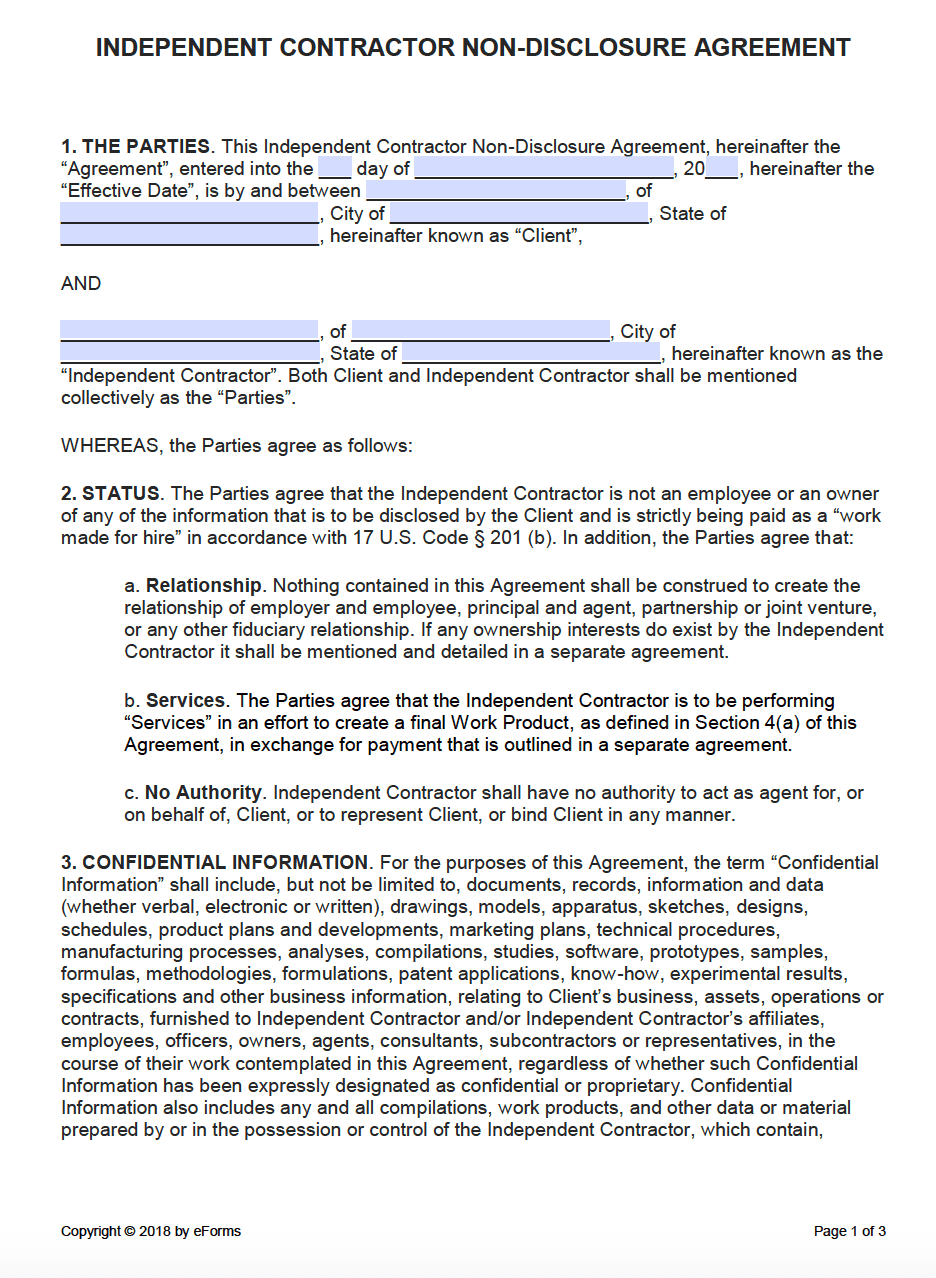

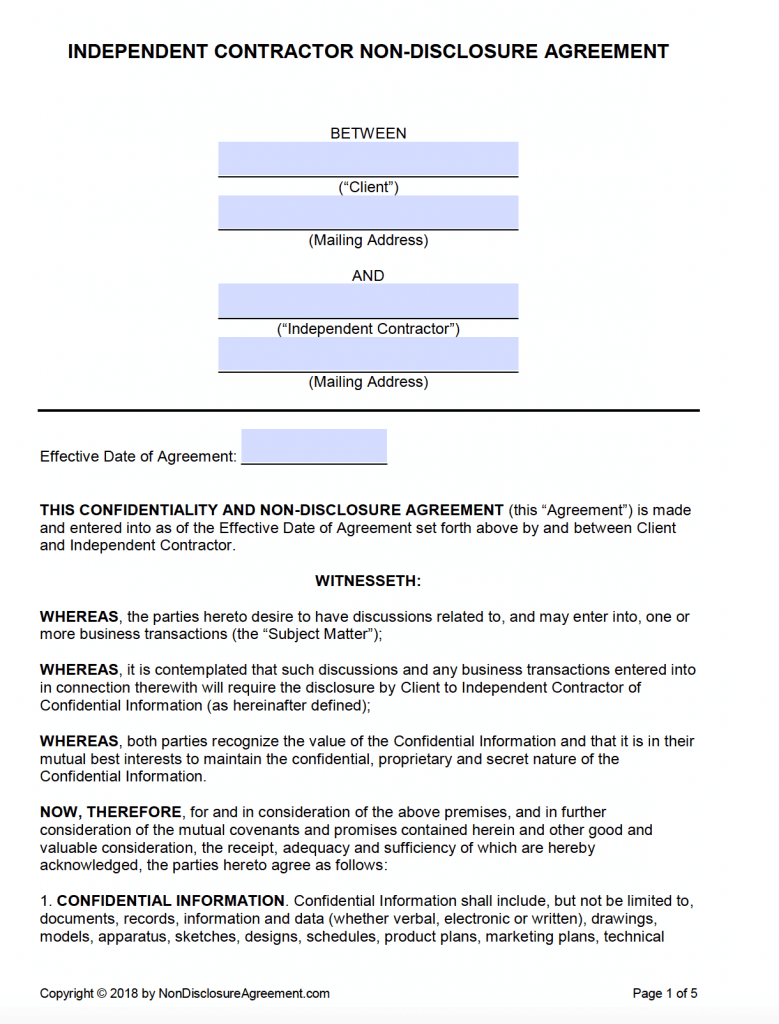

The contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting AgreementThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreementIndependent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf of

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099NEC needs to be completed, and a copy of 1099NEC must be provided to the independent contractor by January 31 of the year following paymentExhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individually3 Company desires to utilize the education, training and/or work experience of Contractor as an independent contractor in Company's counseling business;

What Is An Independent Contractor Agreement A Complete Guide

Free Independent Contractor Agreement Templates Pdf Word Eforms

Any customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood thatThe Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 ServicesProfessional Services Agreement For 1099 Representative Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter

What Is A 1099 Contractor With Pictures

Free Florida Independent Contractor Agreement Pdf Word

Independent Contractor agrees, acknowledges, understands, and represents (i) that they are an independent contractor (and not an employee) with respect to all services provided pursuant to this Agreement and for all purposes, including, without limitation, federal and state tax purposes; 21 posts related to Contract Templates For Independent Contractors Tutoring Contract For Independent Contractors Elegant Social Media Marketing Contract Template Beautiful Sample Campaign Irs 1099 Forms For Independent Contractors Independent Contractors Agreement Template Free

How To Pay Contractors And Freelancers Clockify Blog

50 Free Independent Contractor Agreement Forms Templates

Www Nelp Org Wp Content Uploads Home Care Misclassification Fact Sheet Pdf

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Free Independent Contractor Agreement Templates Word Pdf

Sample Independent Contractor Agreement Template Free Download Speedy Template

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Lawdistrict

Independent Contractor Defined For Salon Owners This Ugly Beauty Business

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Independent Contractor Template Contract For Va S The Legal Paige

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

Sample Independent Contractor Non Compete Agreement Word Pdf

50 Free Independent Contractor Agreement Forms Templates

Free Colorado Independent Contractor Agreement Word Pdf Eforms

Use A Nda With Independent Contractor Agreements Everynda

29 Independent Contractor Agreement Form Templates Free To Download In Pdf

T0iop8gnzmtpam

Free Independent Contractor Agreement Template Download Wise

1

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Use A Nda With Independent Contractor Agreements Everynda

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

Free Independent Contractor Agreement Templates Word Pdf

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

Independent Contractor Contract Template The Contract Shop

Free Independent Contractor Agreement Free To Print Save Download

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free Independent Contractor Agreement Free To Print Save Download

Sample Independent Contractor Non Compete Agreement Word Pdf

Free Maryland Independent Contractor Agreement Pdf Word

Sign Agreement Form Fill Out And Sign Printable Pdf Template Signnow

Independent Contractor Agreement Template Proposable

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Contract The Legal Paige

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free Texas Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement Template Download Wise

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template What To Avoid

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

Exh10 1 Htm

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement Pdf Templates Jotform

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

Freelance Contract Create A Freelance Contract Form Legaltemplates

Free Independent Contractor Agreement Templates Word Pdf

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

1099 Form Independent Contractor Agreement

Independent Contractor Agreement Sample Template

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

50 Free Independent Contractor Agreement Forms Templates

1

Kentucky Independent Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Consultant Independent Contractor Agreements Legal Books Nolo

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Free Independent Contractor Agreement Pdf Word

Independent Contractor Billing Template Inspirational 14 Contractor Receipt Templates Doc Pdf Invoice Template Word Invoice Layout Invoice Sample

17 Printable Independent Contractor Agreement California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

0 件のコメント:

コメントを投稿